Mastering Your Auto Loan: A Guide to Staying Ahead of the Game

When it comes to purchasing a car, many people rely on auto loans to make their dreams a reality. However, before diving into the world of auto loans, it's crucial to understand the fundamentals. An auto loan is a financial product that allows individuals to borrow money to purchase a vehicle. The loan is then repaid over a specified period, typically in monthly installments.

Before taking out an auto loan, it's essential to determine your budget. Understanding your financial situation and how much you can comfortably afford to spend on a car is crucial. Consider your monthly income, expenses, and any other financial obligations you have. By setting a realistic budget, you can avoid overextending yourself and ensure that you'll be able to make your auto loan payments on time.

The Importance of Budgeting for an Auto Loan

Budgeting is a critical aspect of managing your finances, especially when it comes to auto loans. It allows you to determine how much you can afford to borrow and helps you avoid taking on excessive debt.

When creating a budget for your auto loan, consider factors such as your monthly income, expenses, and savings goals. It's important to be realistic and factor in all potential costs associated with owning a car, including insurance, maintenance, and fuel.

By carefully budgeting for your auto loan, you can also ensure that you're able to make your payments on time. Late or missed payments can have severe consequences, such as damaging your credit score or even repossession of your vehicle. Therefore, it's crucial to allocate a portion of your budget specifically for your auto loan payment. Consider automating your payments to avoid any potential late fees or penalties.

Choosing the Right Auto Loan Lender

When it comes to selecting an auto loan lender, it's essential to do your research and compare different options. Start by checking with local banks and credit unions, as they often offer competitive interest rates and flexible repayment terms. Online lenders are also becoming increasingly popular due to their convenience and competitive rates. Take the time to compare interest rates, loan terms, and any additional fees or charges associated with each lender.

Before finalizing your decision, make sure to read and understand the terms and conditions of the loan agreement.

Pay close attention to the interest rate, repayment schedule, and any potential penalties for early repayment. Additionally, consider the lender's reputation and customer reviews to ensure that you're working with a reputable institution.

Tips for Getting the Best Auto Loan Interest Rates

Securing a favorable interest rate on your auto loan can save you a significant amount of money over the life of the loan. Here are some tips to help you get the best interest rates:

- Maintain a good credit score: Lenders use your credit score to assess your creditworthiness. A higher credit score typically translates to lower interest rates. Make sure to pay your bills on time, keep your credit utilization low, and avoid taking on unnecessary debt.

- Shop around: Don't settle for the first loan offer you receive. Take the time to compare rates from different lenders and negotiate for better terms. This can help you secure a lower interest rate and save money in the long run.

- Consider a shorter loan term: While longer loan terms may offer lower monthly payments, they often come with higher interest rates. Opting for a shorter loan term can help you save on interest and pay off your loan faster.

How to Improve Your Credit Score for a Better Auto Loan

Your credit score plays a significant role in determining the interest rate you'll be offered on your auto loan. If your credit score is less than ideal, there are steps you can take to improve it:

- Pay your bills on time: Late or missed payments can have a negative impact on your credit score. Make sure to pay all your bills, including credit card payments, on time.

- Reduce your credit utilization: Aim to keep your credit utilization ratio below 30%. This means using no more than 30% of your available credit. Paying down your credit card balances can help improve your credit score.

- Dispute any errors on your credit report: Regularly check your credit report for any errors or inaccuracies. If you find any, make sure to dispute them with the credit reporting agencies to have them corrected.

- Avoid new credit applications: Opening new credit accounts can temporarily lower your credit score. Try to avoid applying for new credit cards or loans while you're in the process of securing an auto loan.

By taking these steps to improve your credit score, you can increase your chances of securing a better interest rate on your auto loan.

Negotiating the Terms of Your Auto Loan

Negotiating the terms of your auto loan can help you secure more favorable terms and potentially save money. Here are some tips for successful negotiation:

- Do your research: Before negotiating, research the current market rates and offers from different lenders. This will give you a better understanding of what's available and help you make a compelling case for better terms.

- Be prepared to walk away: If a lender is unwilling to negotiate or offer competitive terms, don't be afraid to walk away. There are plenty of other lenders out there who may be willing to meet your needs.

- Use pre-approval to your advantage: Getting pre-approved for an auto loan can give you leverage during negotiations. It shows the seller that you're a serious buyer and have already secured financing.

- Focus on the total cost, not just the monthly payment: While it's important to consider the monthly payment, don't overlook the total cost of the loan. Pay attention to the interest rate, loan term, and any additional fees or charges.

By negotiating the terms of your auto loan, you can ensure that you're getting the best possible deal and saving money in the process.

Understanding the Different Types of Auto Loan Options

When it comes to auto loans, there are several options available, each with its own advantages and considerations. Here are the most common types of auto loans:

- Traditional auto loans: These loans are offered by banks, credit unions, and online lenders. They involve borrowing a specific amount of money with a fixed interest rate and repayment term. Monthly payments are made until the loan is fully repaid.

- Dealership financing: Many car dealerships offer financing options to their customers. While convenient, these loans may come with higher interest rates or additional fees. It's important to carefully review the terms and compare them with other lenders before making a decision.

- Leasing: Leasing a car involves paying for the use of the vehicle over a specified period, typically two to three years. Monthly payments are generally lower than for a traditional loan, but you don't own the vehicle at the end of the lease term.

- Refinancing: If you're unhappy with your current auto loan terms or interest rate, you may consider refinancing. This involves taking out a new loan to pay off your existing loan, potentially with more favorable terms.

It's important to carefully consider your needs, financial situation, and long-term goals when choosing the right auto loan option for you.

The Pros and Cons of Leasing vs. Buying a Car

When deciding whether to lease or buy a car, it's essential to weigh the advantages and disadvantages of each option:

Leasing:

- Pros:

- Lower monthly payments

- Ability to drive a new car every few years

- Minimal repair and maintenance costs

- Cons:

- No ownership of the vehicle

- Mileage restrictions and penalties for excess mileage

- Potential for additional fees at the end of the lease

Buying:

- Pros:

- Ownership of the vehicle

- No mileage restrictions

- Ability to customize and modify the car

- Cons:

- Higher monthly payments

- Depreciation of the vehicle's value over time

- Higher repair and maintenance costs

Ultimately, the decision between leasing and buying depends on your personal preferences, financial situation, and long-term goals.

How to Stay Ahead of Your Auto Loan Payments

Once you've secured an auto loan, it's crucial to stay on top of your payments to avoid any negative consequences. Here are some tips to help you stay ahead:

- Set up automatic payments: Automating your payments can ensure that they are made on time, every time. This can help you avoid late fees and penalties.

- Create a budget: As mentioned earlier, budgeting is crucial for managing your auto loan payments. By allocating a portion of your budget specifically for your loan payment, you can ensure that you have enough funds available each month.

- Prioritize your auto loan: Make your auto loan payment a priority. If you're facing financial difficulties, communicate with your lender to explore options such as deferment or loan modification.

- Plan for unexpected expenses: It's important to have an emergency fund in place to cover unexpected expenses. This can help you avoid falling behind on your auto loan payments if you encounter unexpected financial challenges.

By following these tips, you can stay ahead of your auto loan payments and maintain a healthy financial situation.

Resources for Managing and Tracking Your Auto Loan

Managing and tracking your auto loan is essential for staying organized and ensuring that you're meeting your financial obligations. Here are some resources that can help:

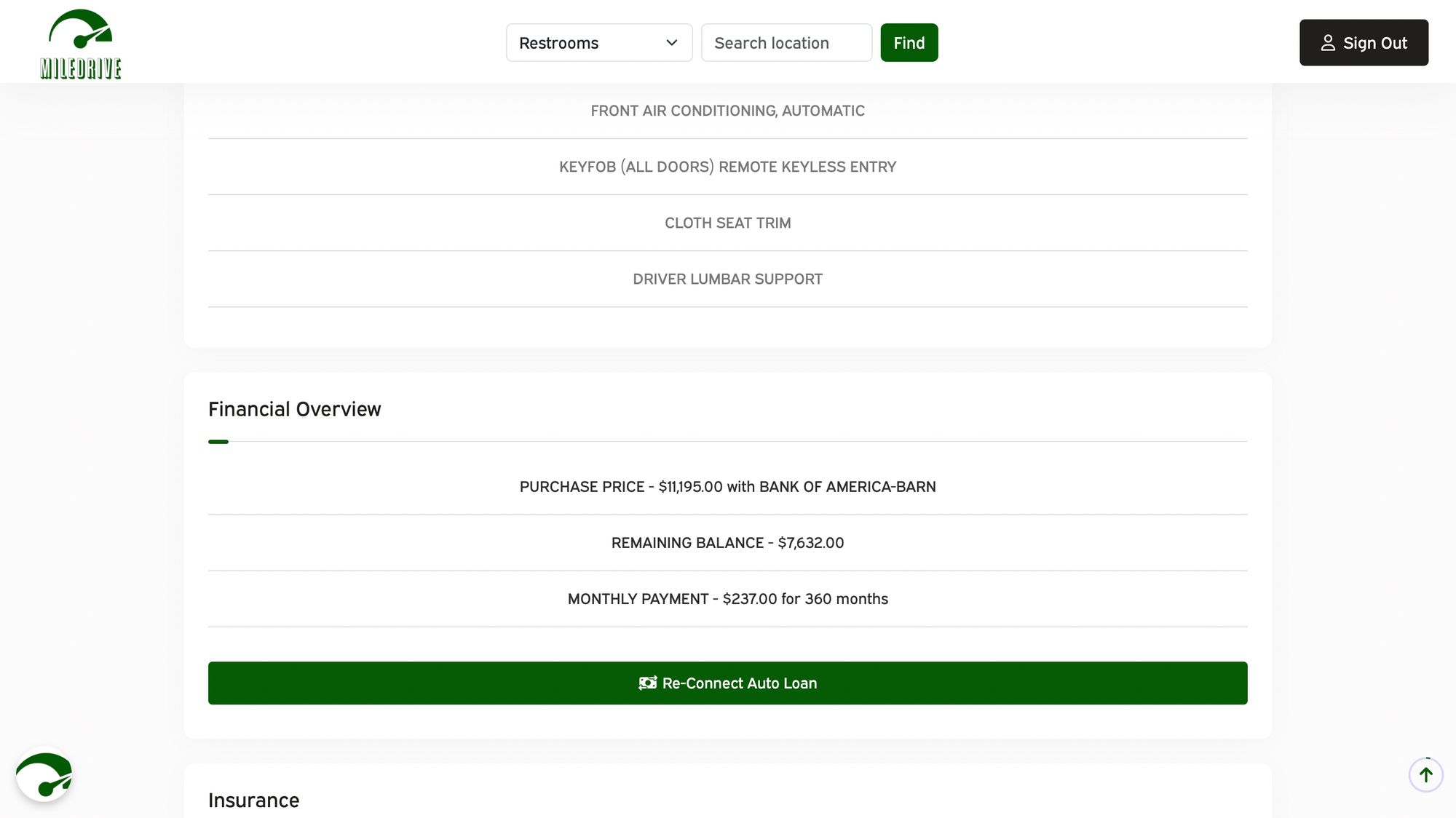

- Online banking: Most banks and lenders offer online banking platforms where you can view your loan details, make payments, and track your progress.

- Mobile apps: There are several mobile apps available that can help you manage and track your auto loan payments. These apps often provide features such as payment reminders, calculators, and budgeting tools.

- Spreadsheets: If you prefer a more hands-on approach, you can create a spreadsheet to track your auto loan payments and progress. This can help you visualize your progress and plan for the future.

- Lender resources: Many lenders provide educational resources and tools on their websites to help borrowers manage their loans effectively. Take advantage of these resources to stay informed and empowered.

By utilizing these resources, you can stay organized, track your progress, and ensure that you're effectively managing your auto loan.

Conclusion

Mastering your auto loan involves understanding the fundamentals, budgeting effectively, choosing the right lender, and staying on top of your payments. By following the tips and strategies outlined in this guide, you can navigate the world of auto loans with confidence and stay ahead of the game.

Remember, taking the time to research, negotiate, and manage your loan effectively can save you money and put you on the path to financial success. So, go ahead and take control of your auto loan journey today!