The Ultimate Guide to Efficiently Tracking Mileage for Your Vehicle

As a vehicle owner, keeping track of your mileage is crucial for several reasons. Firstly, it helps you maintain accurate records of your vehicle's usage, which can be invaluable when it comes to resale value or insurance claims. Secondly, tracking mileage can assist you in budgeting for fuel costs and scheduling routine maintenance, ensuring your car remains in optimal condition.

Additionally, for those who use their vehicles for business purposes or claim mileage deductions on their taxes, accurate mileage tracking is a legal requirement.

Different methods for tracking mileage

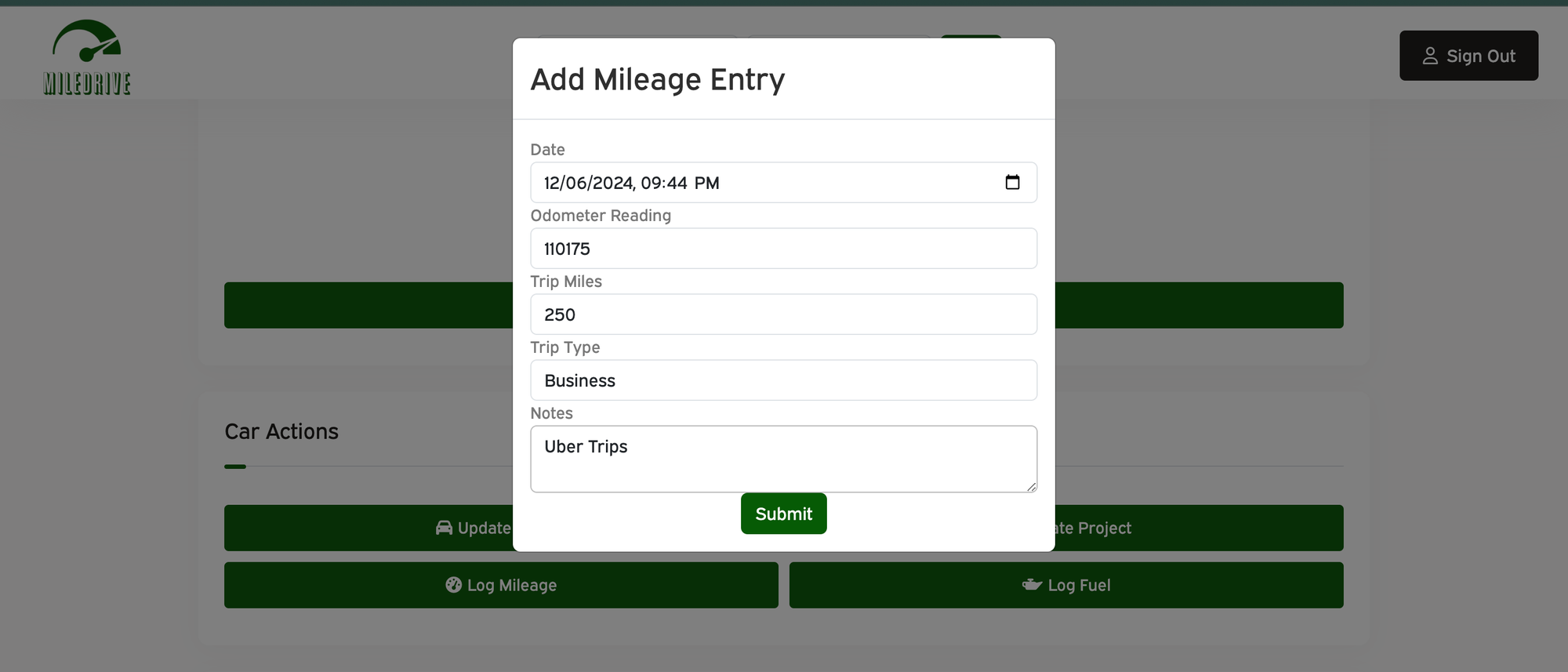

There are various methods available for tracking mileage, each with its own advantages and drawbacks. The traditional approach involves manually recording odometer readings at the start and end of each trip, which can be tedious and prone to errors. Another option is to use a mileage tracking device or app, which can automatically record your mileage and provide detailed reports.

The benefits of using mileage tracking apps

In today's digital age, mileage tracking apps have become increasingly popular due to their convenience and accuracy. These apps leverage GPS technology to automatically record your trips, eliminating the need for manual data entry. Many apps also offer additional features such as fuel cost tracking, maintenance reminders, and trip categorization for business or personal use.

One of the most significant advantages of using a mileage tracking app is the time and effort it saves. Instead of manually recording odometer readings or keeping track of receipts, the app does all the work for you, ensuring accurate and up-to-date mileage records.

Tips for efficient mileage tracking

- Choose the right mileage tracking method: Evaluate your needs and preferences to determine the most suitable method for tracking your mileage. Consider factors such as ease of use, accuracy, and cost.

- Be consistent: Regardless of the method you choose, consistency is key. Establish a routine for tracking your mileage and stick to it to ensure accurate records.

- Categorize your trips: If you use your vehicle for both personal and business purposes, be sure to categorize your trips accordingly. This will make it easier to separate mileage for tax purposes or reimbursement claims.

- Update your records regularly: Don't let mileage records pile up. Update them regularly to avoid missing important trips or forgetting details.

- Backup your data: Whether you're using a physical logbook or a digital app, it's essential to backup your mileage data regularly to prevent data loss.

How tracking mileage can save you money

Accurate mileage tracking can save you money in several ways. First and foremost, it can help you identify opportunities to reduce unnecessary driving and optimize your routes, resulting in significant fuel savings over time. Additionally, by keeping precise records of your vehicle's mileage, you can better anticipate and plan for maintenance and repair costs, avoiding costly breakdowns or premature wear and tear.

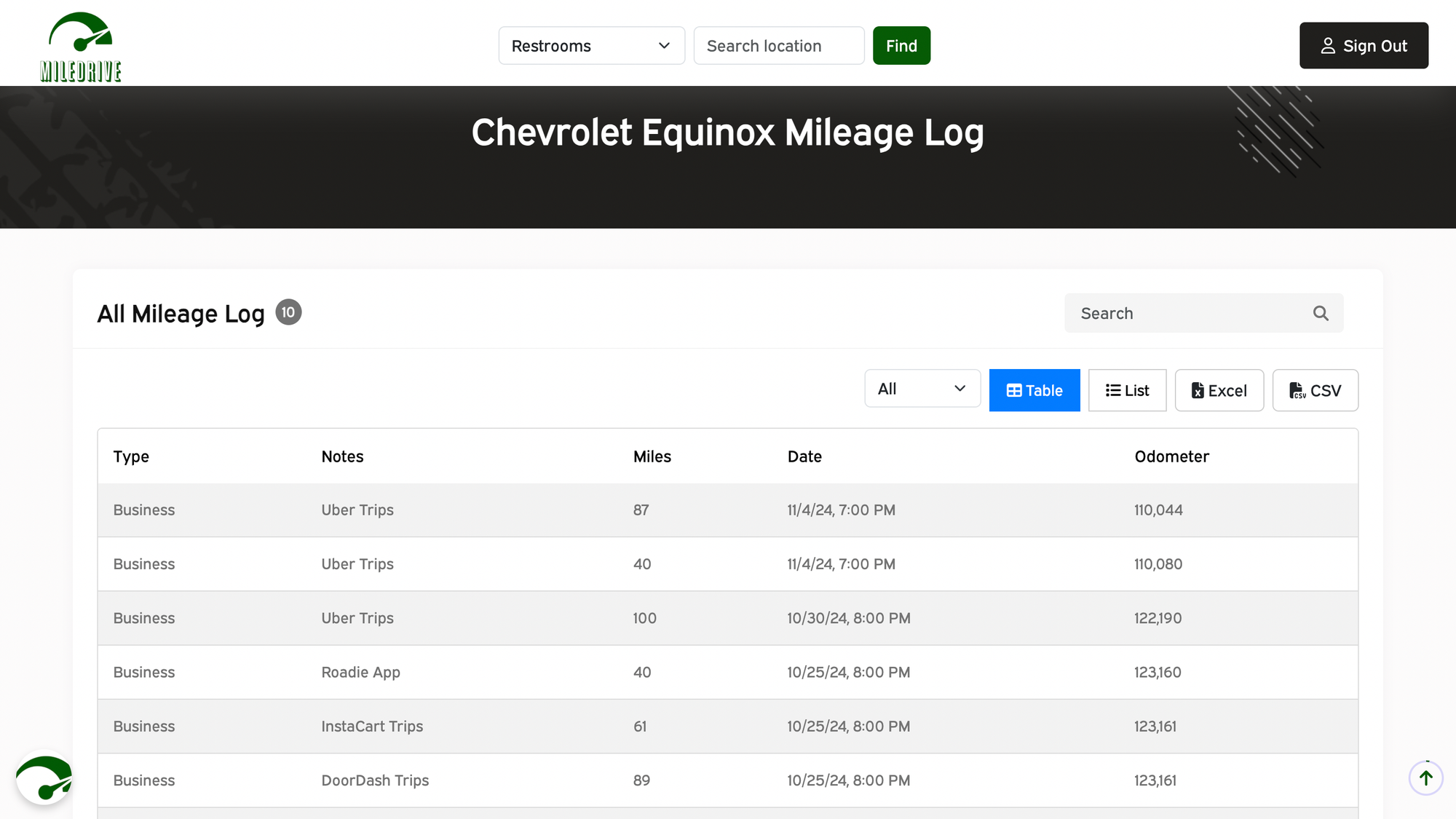

For business owners or self-employed individuals, tracking mileage is essential for claiming tax deductions. The Internal Revenue Service (IRS) allows taxpayers to deduct a certain amount per mile driven for business purposes, which can add up to substantial savings come tax season.

Mileage tracking for business purposes

If you use your vehicle for business purposes, such as client meetings, site visits, or deliveries, accurate mileage tracking is crucial. Not only does it help you claim legitimate tax deductions, but it also provides valuable data for analyzing your business's transportation costs and optimizing routes for efficiency.

Many mileage tracking apps offer features specifically designed for business users, such as the ability to categorize trips by client or project, generate detailed reports, and integrate with accounting software.

Mileage tracking for tax deductions

One of the primary reasons for tracking mileage is to claim tax deductions. The IRS allows taxpayers to deduct a certain amount per mile driven for business, medical, or moving purposes. However, to claim these deductions, you must maintain accurate records of your mileage.

Keeping a detailed mileage log can help substantiate your deductions in the event of an audit. Many mileage tracking apps generate IRS-compliant reports, making it easier to file your taxes and maximize your deductions.

Mileage tracking for car maintenance and repairs

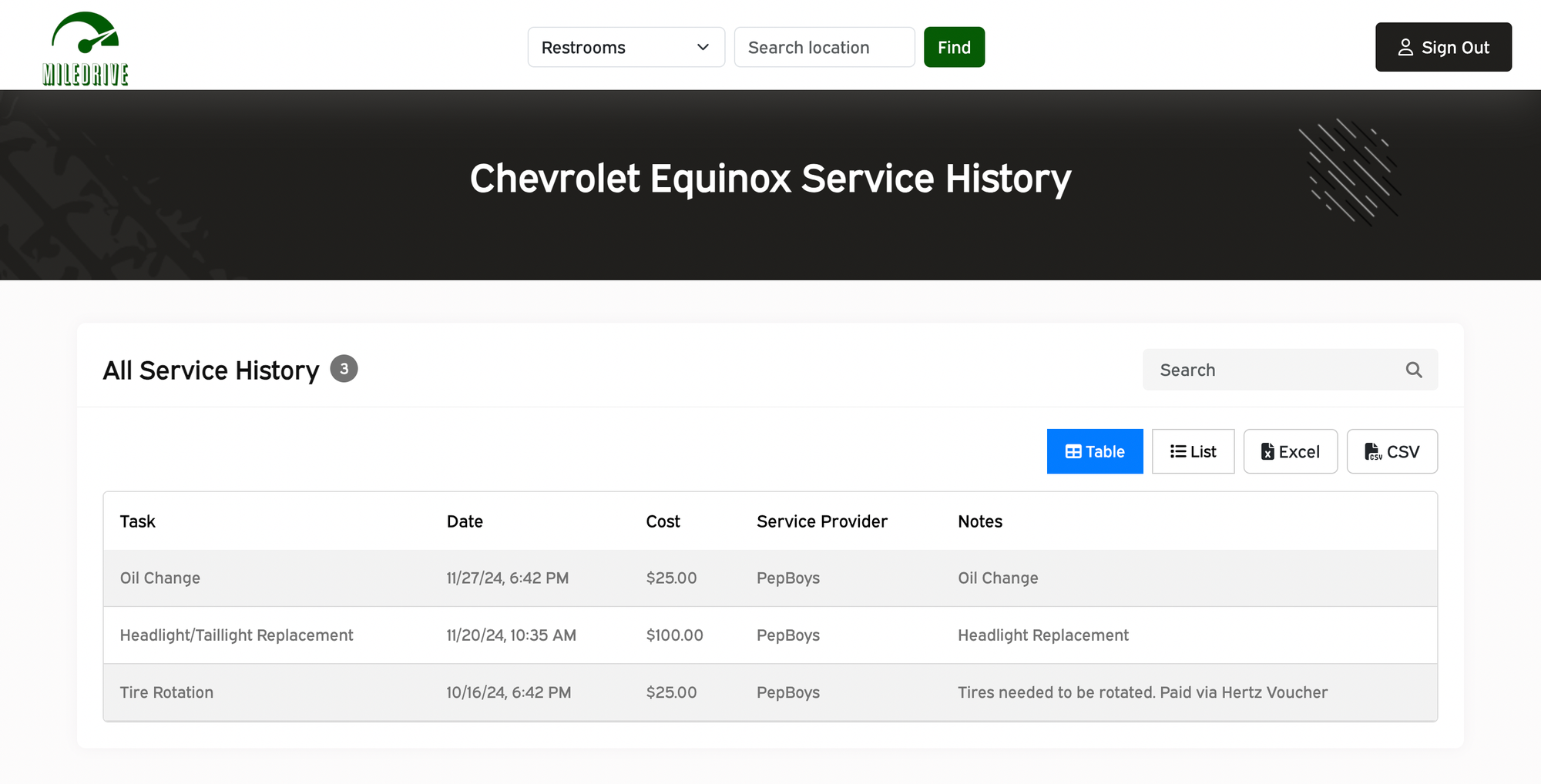

Keeping track of your vehicle's mileage can also help you stay on top of routine maintenance and repairs. Most manufacturers recommend specific service intervals based on mileage, such as oil changes, tire rotations, and brake inspections. By monitoring your mileage, you can ensure that you don't miss these important maintenance tasks, which can extend the lifespan of your vehicle and prevent costly breakdowns.

Additionally, accurate mileage records can be useful when negotiating the trade-in value of your vehicle or making a case for warranty repairs. Many warranties are based on mileage, and having precise records can help you ensure that you receive the coverage you're entitled to.

Mileage tracking for trip planning and budgeting

Whether you're planning a road trip or simply commuting to work, tracking your mileage can be a valuable tool for trip planning and budgeting. By analyzing your past mileage data, you can estimate fuel costs, plan rest stops, and even identify opportunities for carpooling or public transportation.

Some mileage tracking apps even integrate with popular navigation apps, allowing you to plan routes, track your progress, and monitor fuel consumption in real-time.

Conclusion: The importance of accurately tracking mileage for your vehicle.

Accurately tracking your vehicle's mileage is an essential task for any responsible car owner. Whether you're looking to maximize tax deductions, plan maintenance schedules, or simply keep tabs on your vehicle's usage, mileage tracking provides valuable insights and data.

With the advent of mileage tracking apps and GPS technology, the process has become more accessible and efficient than ever before. By incorporating mileage tracking into your routine, you can save money, extend the life of your vehicle, and enjoy the peace of mind that comes with having accurate records at your fingertips.

If you're ready to take control of your vehicle's mileage and unlock the benefits of efficient tracking, consider signing up for MileDrive. With its user-friendly interface, service history, expenses, and customizable reporting features, you'll never have to worry about missing a mile or losing track of your records again.