Unveiling the True Cost of Vehicle Ownership

Owning a vehicle is a significant financial commitment that goes beyond the initial purchase price. Many people underestimate the true cost of owning a car, which can lead to financial strain and unexpected expenses. In this ultimate guide, I will uncover the various aspects of vehicle ownership costs and provide you with practical tips to manage them effectively.

Understanding the initial costs of buying a car

When considering purchasing a car, it's important to look beyond the sticker price. Additional expenses such as sales tax, registration fees, and dealership charges can significantly increase the initial cost. Don't forget to factor in the cost of accessories, upgrades, and extended warranties as well. It's advisable to conduct thorough research, compare prices, and negotiate with dealerships to ensure you get the best deal possible.

Hidden costs of vehicle ownership

Beyond the initial purchase, there are several hidden costs associated with owning a vehicle. One of the most significant expenses is insurance. The cost of insurance premiums varies depending on factors such as the make and model of the car, your driving record, and your location. It's essential to obtain multiple insurance quotes and consider factors that can lower your premiums, such as installing anti-theft devices or completing defensive driving courses.

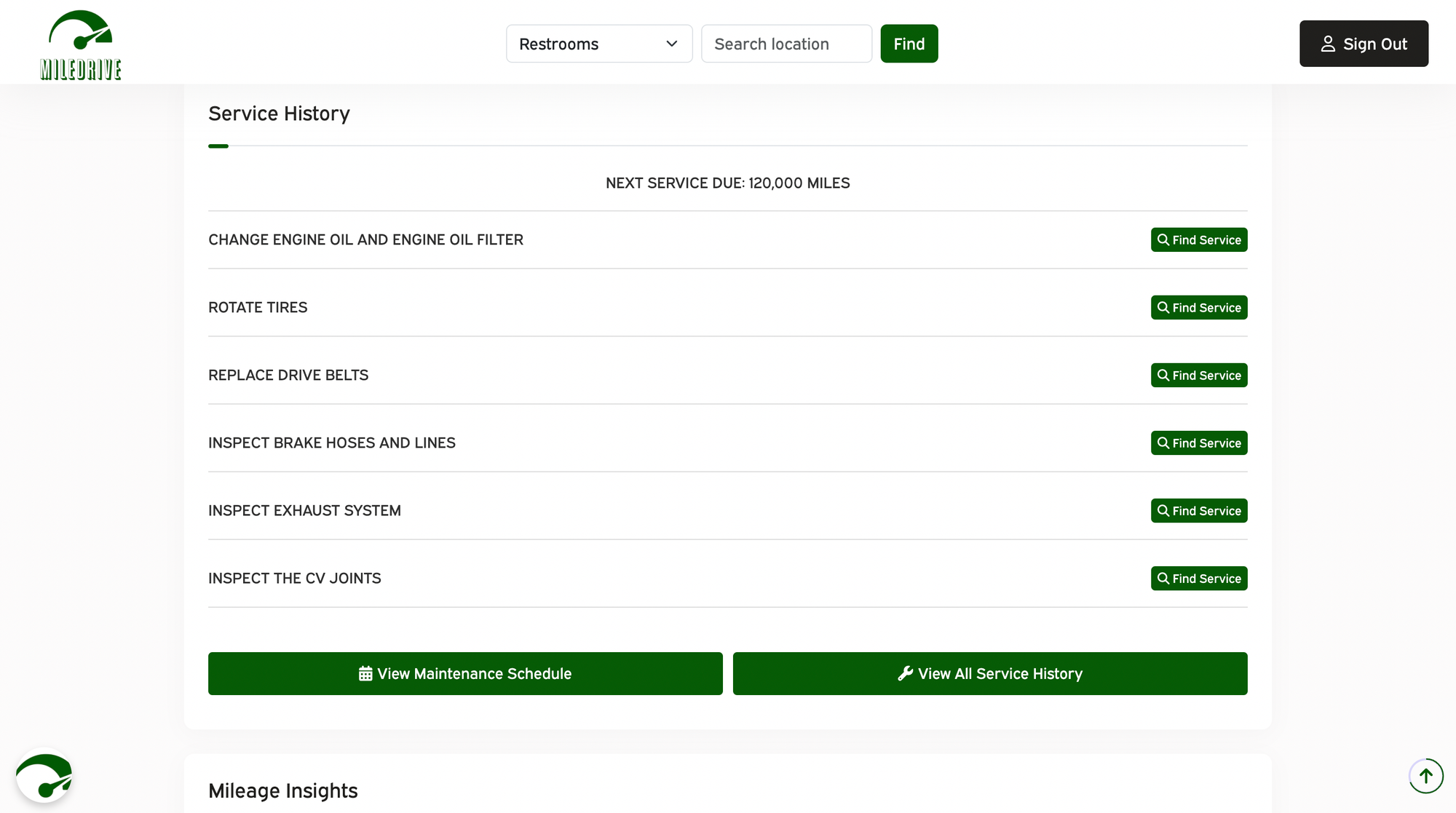

Regular maintenance and servicing expenses are another hidden cost that car owners often overlook. Routine maintenance, such as oil changes, tire rotations, and brake inspections, are necessary to keep your vehicle running smoothly and prevent costly repairs down the road. Budgeting for these expenses and following the manufacturer's recommended maintenance schedule can help you avoid unexpected breakdowns and costly repairs.

Fuel costs and efficiency considerations should also be taken into account. The type of vehicle you choose, its fuel efficiency rating, and the distance you drive all impact your fuel expenses. Opting for a fuel-efficient vehicle, carpooling, or using public transportation when possible can help reduce your monthly fuel costs.

Insurance expenses and factors affecting premiums

Insurance is a necessary expense for vehicle owners, but the premiums can vary significantly based on various factors. The make and model of your car play a role in determining your insurance premiums. Sports cars and luxury vehicles typically have higher insurance costs due to their higher risk of accidents and theft.

Additionally, your driving record, age, gender, and even your credit score can influence the cost of your insurance premiums. To manage insurance expenses, consider maintaining a clean driving record, opting for a safer and more practical vehicle, and exploring discounts offered by insurance providers.

Depreciation and resale value

One often overlooked cost of vehicle ownership is depreciation. As soon as you drive a new car off the lot, it begins to lose value. Depreciation can be a significant expense if you plan to sell or trade in your vehicle in the future.

To minimize depreciation, consider purchasing a vehicle with a good resale value, maintaining it well, and keeping the mileage as low as possible. Additionally, regular maintenance and addressing any cosmetic damages promptly can help preserve the value of your car.

Financing options and interest rates

Many people choose to finance their vehicle purchase, which adds another layer of cost to ownership. When exploring financing options, it's crucial to consider the interest rates offered by different lenders. Even a small difference in interest rates can have a significant impact on the overall cost of the loan. Shop around for the best rates, negotiate with lenders, and consider making a larger down payment to reduce the total interest paid over the loan term. Carefully review the terms and conditions of the loan to ensure you understand all associated costs and fees.

Tips for managing the costs of vehicle ownership

Managing the costs of vehicle ownership requires careful planning and budgeting. Here are some practical tips to help you keep your expenses in check:

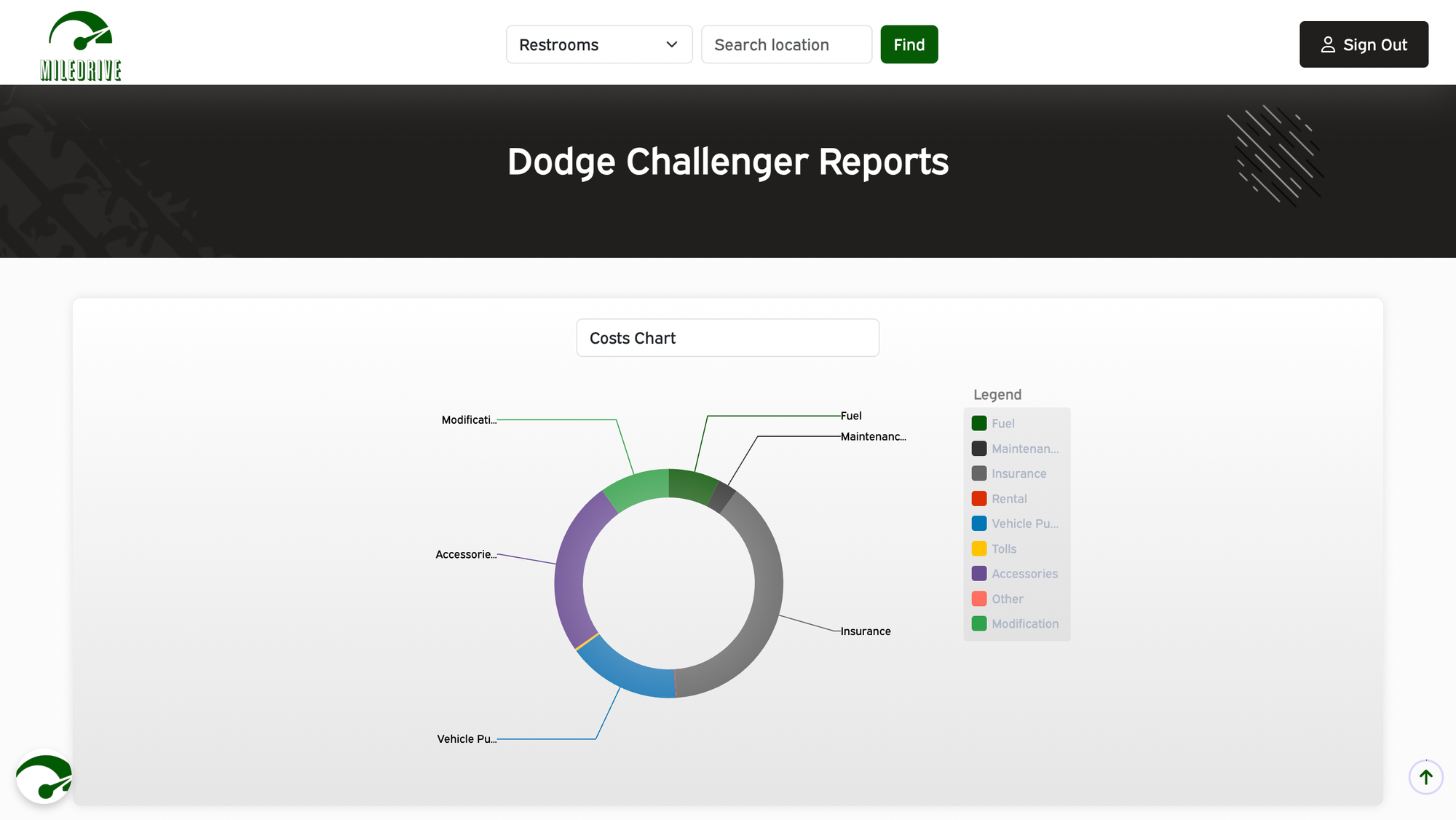

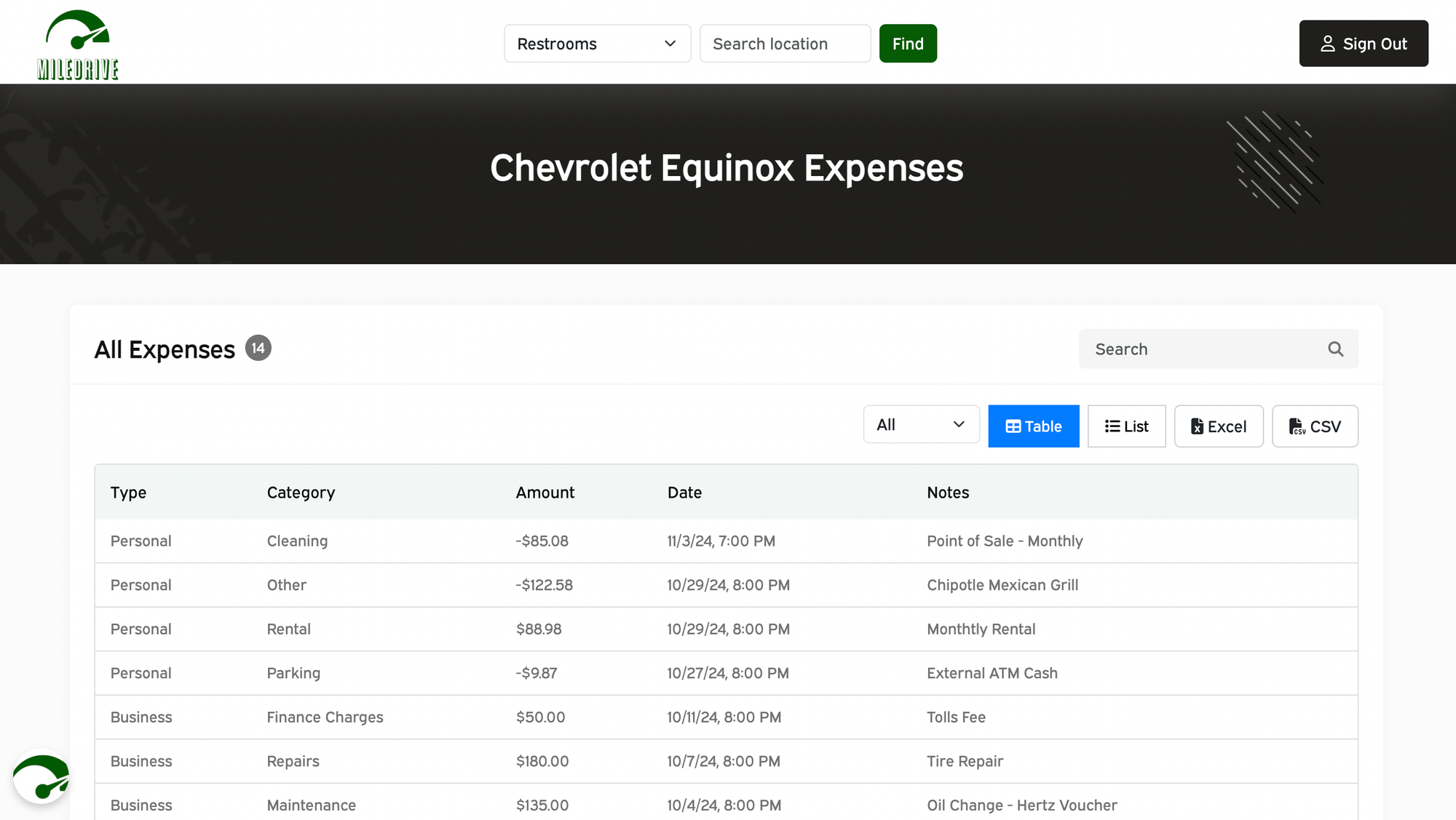

- Track your car expenses: Utilize tools and apps specifically designed for tracking and budgeting car expenses. This will help you identify areas where you can cut costs and make informed decisions about your vehicle ownership.

- Consider alternative transportation options: Evaluate if there are alternative transportation options available in your area, such as public transportation, car-sharing services, or biking. Using these alternatives for certain trips can help reduce the wear and tear on your vehicle and save on fuel costs.

- Practice preventive maintenance: Regularly maintain your vehicle according to the manufacturer's recommendations. This will help prevent major repairs and extend the lifespan of your car, ultimately saving you money in the long run.

- Shop around for insurance: Don't settle for the first insurance quote you receive. Shop around, compare prices, and take advantage of discounts or bundled insurance policies to get the best deal.

- Monitor fuel efficiency: Pay attention to your driving habits and fuel consumption. Avoid aggressive driving, maintain proper tire pressure, and consider using fuel-efficient additives to improve fuel efficiency and save money.

Conclusion: Taking control of your car ownership costs

Owning a car comes with a myriad of costs beyond the initial purchase price. By understanding and accounting for these costs, you can effectively manage your vehicle ownership expenses. From the hidden costs of insurance and regular maintenance to fuel expenses and depreciation, being proactive and implementing cost-saving strategies will help you maintain control over your car ownership costs.

Remember to track your expenses, explore alternative transportation options, practice preventive maintenance, and make informed decisions when it comes to insurance and financing. With careful planning and budgeting, you can enjoy the benefits of vehicle ownership without breaking the bank.